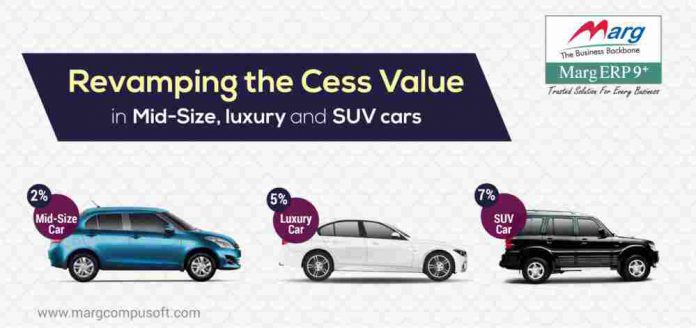

The boost in the cess on Goods and Service Tax (GST) on mid- sized, luxury and SUV cars has been enforced from 11 th September a major decision taken in the GST council meeting held on 9 th September 2017, at Hyderabad. The Hike in cess rates by 2%, 5% and 7% for mid-sized, large cars and SUVs respectively has led the GST rates to a max of 50%.

Mr. Arun Jaitely said that the increase in cess percentage in large vehicles was a decision taken due to the affordability of consumers. He also mentioned that the head space for escalating cess was up to 10% while the original hike was done only by 7%.

Cess value for entry level car segments like Alto, Eon, Kwid, Maruti 800 and diesel cars, and hybrid cars remained untouched making the segment safe as before. With the onset of GST, the car prices were already declined by Rs 3 lakh lower than the combined Central and State taxes in pre-GST days.

To fix this aberration, the Council decided to hoist the cess rate in all the three section i.e. mid- sized, luxury and SUV cars. The amendment in the cess rate in three sections has made vehicles rates at par with that of prevailing pre-GST roll out prices

If we see the highest pre GST tax rate in the large vehicle section it was estimated at around 52 %to 54% wherein 2.5% was added as Central sales tax, octroi etc. Against this, the post GST taxes which has reached to 43% was further revised by GST council making the GST tax rate to a max of 50%.With the correction in cess quantum, now the oddities have been evacuated to a more prominent degree.